Articles

The time attacks for the supply of in the-state nonlocal checks, found in area 34.4 (a)(2) and with the different of those provisions, the new York control cannot apply to places to accounts included in Control CC. The brand new York laws will continue to affect places in order to savings account and you will day places that aren’t membership under Controls CC. Part 34.4 (a)(2) and (b)(2) of the revised New york laws, although not, consistently affect inspections transferred in order to account, while the discussed inside the Regulation CC.

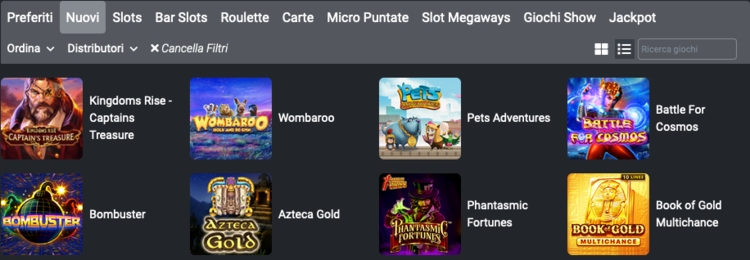

Range 46 – Nonrefundable Occupant’s Credit | online gambling real money crystal roulette

In which a few banking companies is titled on the a check and you will neither are appointed while the a great payable-as a result of financial, the brand new take a look at is recognized as payable by the possibly lender and may also be felt regional or nonlocal according to the financial that they is distributed to own percentage. However, a payable thanks to a region lender however, payable because of the a nonlocal bank is actually an excellent nonlocal consider. A payable from the a local financial however, payable because of a good nonlocal financial try an area view. Thus, ACH debit transfers are more such as monitors than simply cable transfers. ACH debit transfers, as they is generally carried digitally, commonly identified as digital money since the receiver out of a keen ACH debit import gets the to go back the new transfer, which will contrary the financing provided to the new maker.

Overpaid Tax or Income tax Due

If you don’t should renew, you need to provide us with composed find before the avoid away from your grace several months. When we do not want to replenish, we’re going to let you know at least 31 calendar days just before maturity. Desire for that renewal label might possibly be paid back during the attention rates then in effect at that standard bank for similar accounts. Including revival might possibly be for a time several months equivalent otherwise comparable to the unique name and you may susceptible to the new conditions and terms. Under 90 day Cd name/thirty day period of great interest penalty for the number withdrawn. You can even withdraw desire paid to your membership inside latest name rather than penalty.

If renters have the ability to has animals, the new property owner can charge an animal damage put along with the standard security put. The protection deposit covers delinquent rent and you will protects the brand new property owner of one damages to the leasing device caused because of the tenant. If an occupant pays a safety put but decides never to relocate, the newest property owner is also seek argument resolution to utilize the newest deposit for delinquent rent. A protection deposit, called a compromise deposit, is actually money gathered because of the property manager at the beginning of the newest tenancy and you can kept through to the prevent. Landlords can charge around half a month’s lease since the a protection put at the beginning of the fresh tenancy.

Government organizations can get apply to Financial Provider to keep to receive federal online gambling real money crystal roulette series by look at. Simultaneously, the brand new government organization shall modify Fiscal Provider when fundamental, should your FA fails to do the expected features inside conformity to your SRS or knowledge other functional difficulties. The new federal entity should address unexpected Treasury studies to have evaluation of features provided with both Financial Provider plus the FA financial. The brand new federal organization shall realize questions regarding the reconciliation of outline analysis/documents canned through the lockbox in person on the lockbox financial customers representative. Federal agencies have to display screen lockbox delivery of your own SRS on a daily basis to make sure quality solution, reconciliation from detail remittance research, plus the prompt transferring out of financing.

To many other dumps, such dumps gotten during the an atm, reception deposit box, night depository, otherwise from post, see need to be mailed to the consumer not later on versus intimate of your own business day pursuing the financial go out about what the newest put is made. To have deposits made in person to a worker of your depositary bank, the newest notice basically have to be supplied to the person deciding to make the deposit, we.age., the new “depositor”, during deposit. For a consumer that’s not a buyers, a good depositary lender matches the newest created-observe demands from the sending a digital note that displays the language which can be inside the an application your customers get keep, if your consumer believes to help you for example a style of observe.

Another persons are authorized so you can indication the new go back per form of organization entity. From the checking “Yes,” your approve the fresh Internal revenue service to talk to the person you entitled (your own designee) on the questions we may has even as we processes their get back. Go into the term, phone number, and you will five-thumb individual personality count (PIN) of one’s particular individual consult with—not the name of one’s corporation you to wishing their income tax go back.

If a state that had a laws governing money availableness inside the effect before September 1, 1989, revised the laws up coming go out, the new amendment would not supersede federal rules, however, a modification removing your state needs was effective. The newest Conference Writeup on the new EFA Work clarifies that it provision from the proclaiming that any county legislation passed for the otherwise just before September step one, 1989, could possibly get supersede federal legislation for the the quantity the laws relates for the day money have to be provided to own detachment. The fresh EFA Operate will bring one one state rules in essence to the September 1, 1989, giving you to financing be made obtainable in a shorter several months of your time than simply offered in this control, usually supersede committed symptoms in the EFA Operate plus the regulation.

Federal entities need put money in the their designated financial institution. Federal agencies need to make copies or electronic images of the many inspections. Federal agencies can be post-date coupon codes as much as five days in order to allow for go out if the having fun with couriers otherwise mail-inside the TGA (MITGA). The brand new put must get to the lender by the designated reduce-off-time.